- Home

- Foreword

- Company portrait

- Strategy and Management

- Governance and Dialogue

- Product responsibility

- Employees

- Environment and Society

- GRI Disclosures

- Sites

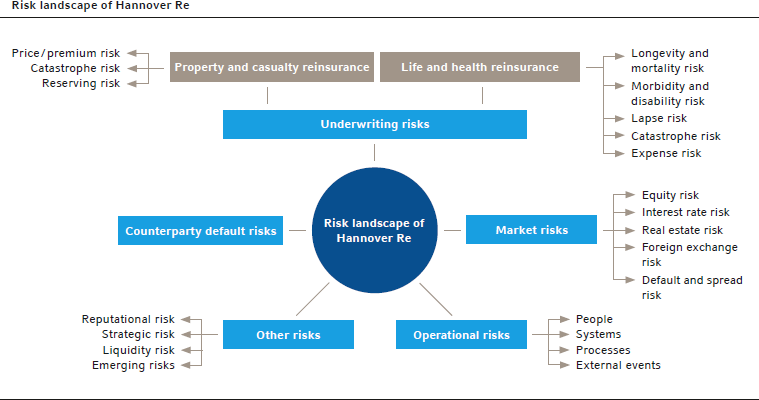

Risk landscape

Our risk landscape encompasses:

- underwriting risks in property & casualty and life & health reinsurance which originate from our business activities and manifest themselves inter alia in fluctuations in loss estimates as well as in unexpected catastrophes and changes in biometric factors such as mortality,

- market risks which arise in connection with our investments and also as a consequence of the valuation of sometimes long-term payment obligations associated with the technical account,

- counterparty default risks resulting from our diverse business relationships and payment obligations inter alia with clients and retrocessionaires,

- operational risks which may derive, for example, from deficient processes or systems and

- other risks, such as strategic, reputational and liquidity risks.

The reputational risk also has a bearing on our social responsibility and is thus a control point for our sustainability efforts.

We make a fundamental distinction between risks that result from business operations of past years (reserve risk) and those stemming from activities in the current or future years.

Emerging risks play a particularly important role for us. This is because the content of such risks cannot as yet be reliably assessed. It is therefore vital to detect these risks at an early stage and then determine their relevance. Emerging risks include those associated with urbanisation as well as risks posed by obesity in industrialised nations, the use of nanotechnology and increasingly widespread digitalisation and cybercrime.

The "Emerging Risks and Scientific Affairs" internal working group and the natural perils risk management team also regularly examine and review the latest scientific insights into climate change. For us, as a reinsurer, climate change brings both risks and opportunities: on the one hand, we can anticipate increased demand for reinsurance services, while on the other hand the potentially elevated catastrophe risk may result in a greater financial burden for our company. Strategies for dealing with the risks inherent in such perils are of the utmost importance to our company as a reinsurer. It is for this reason that our department specialising in the coverage of agricultural risks and the "Innovation Management" team work on products that can alleviate the financial impacts of climate change.

In the context of our work in the Emerging Risks Initiative (ERI) of the CRO Forum, we are also investigating investment opportunities in so-called greentechs, which could increase our corporate contribution to CO2 reduction.