- Home

- Foreword

- Company portrait

- Strategy and Management

- Governance and Dialogue

- Product responsibility

- Employees

- Environment and Society

- GRI Disclosures

- Sites

Organisational profile

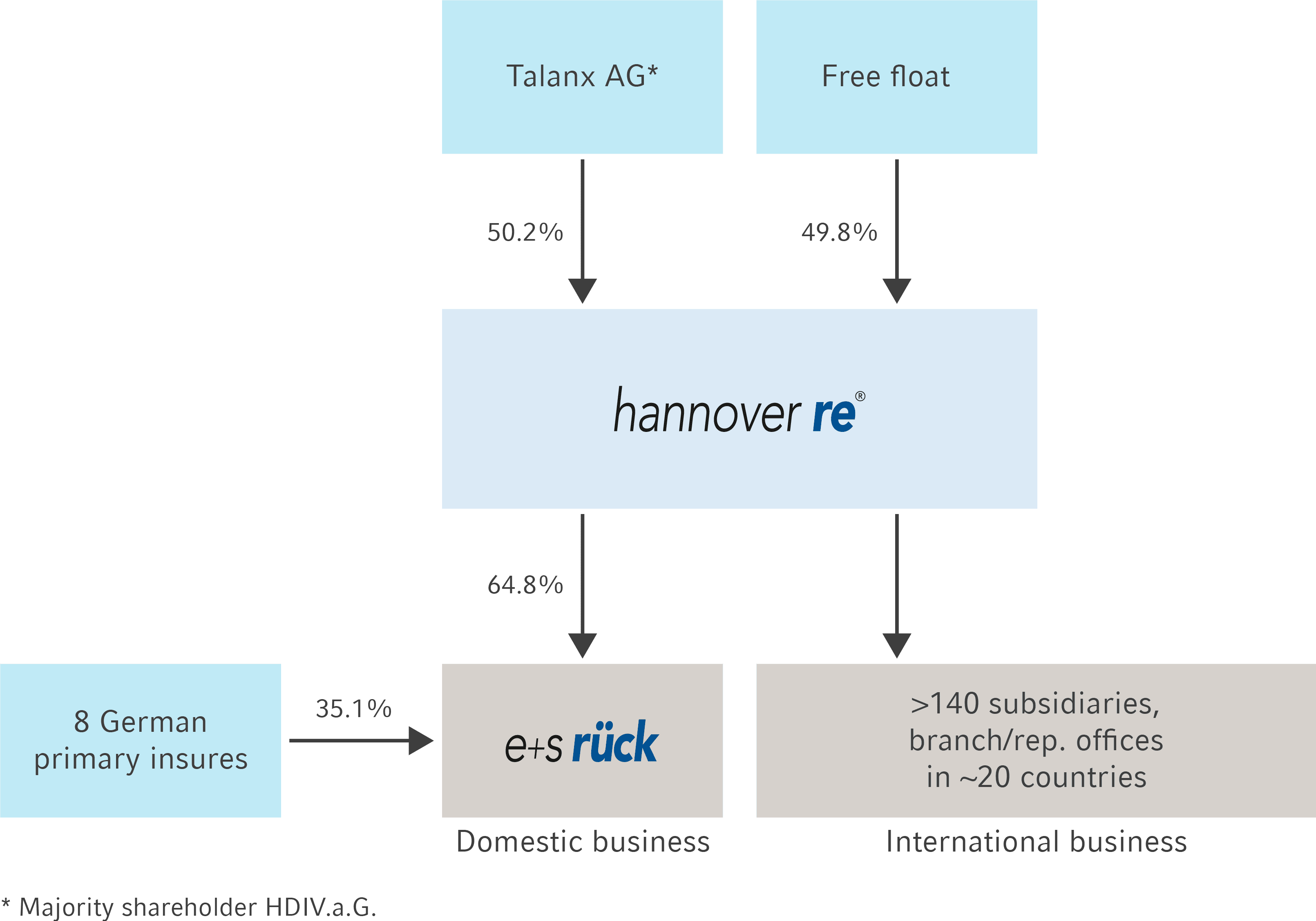

Operational Group structure

Our Group is organised according to strategic business groups, i.e. split into Property & Casualty and Life & Health reinsurance.

Of the total gross premium of EUR 17.8 billion written in 2017, 60% was attributable to property and casualty reinsurance and 40% to life and health reinsurance. Our products and solutions are subject to extensive legal regulations. We consistently comply with legal provisions and exceed them in many areas in keeping with our own internal standards.

An overview of the breakdown of gross premium by regions for the property and casualty reinsurance business group and by markets for the life and health reinsurance business group is published in our Annual Report.

In property and casualty reinsurance we assume risks from our clients in accordance with our margin-oriented underwriting policy and thereby enable them to reduce their underwriting risks. Reflecting the areas of Board responsibility, we break this business group down into three subsegments:

- our defined target markets, namely Continental Europe and North America,

- specialty lines, i.e. marine, aviation, credit, surety and political risks, facultative reinsurance as well as the United Kingdom, Ireland, London Market and direct business,

- global reinsurance, i.e. worldwide treaty reinsurance, natural catastrophe business as well as structured reinsurance and insurance-linked securities (ILS).

We split the business written in life and health reinsurance into the areas of financial solutions and risk solutions. The latter area is, in turn, differentiated according to the risk types of longevity, mortality and morbidity. Our clientele includes life and health insurers, banks, sales companies and pension funds.

In addition to the regional and treaty departments, the Group's main organisational units are Innovation Management and Risk Management, Controlling as well as Finance and Accounting, Information Technology, Investments, Human Resources Management, Group Legal Services and Compliance, Group Auditing, Corporate Development, Corporate Communications and Facility Management.

The Group worldwide

Hannover Re's infrastructure is comprised of more than 140 subsidiaries, affiliates, branches and representative offices around the world with a total workforce of 3,251 (valid: 31 December 2017). In addition to the Home Office in Hannover with 1,385 employees (42.6% of the workforce), our major locations are in South Africa (488 employees; 15%), the United Kingdom (386 employees; 11.9%) as well as the United States (290 employees; 8.9%) and Sweden (199 employees; 6.1%).

Material changes in our Group structure are described in the Group Annual Report 2017 (Notes 4.3-4.5). These include the major acquisitions and new formations, disposals and retirements as well as other corporate changes.

A complete list of our shareholdings is provided on page 170 et seq. of the notes in our Annual Report 2017. The addresses of the Hannover Re Group's international locations are to be found in the section "Further information" on page 262 et seq.

Shareholder structure

Our company is an European Company, Societas Europaea (SE). The long-standing principal shareholder of our company is Talanx AG, which is majority-owned by "Haftpflichtverband der Deutschen Industrie" (HDI). As a mutual insurance company, HDI's focus on long-term corporate success plays a positive part in sustainable value creation.