- Home

- Foreword

- Company portrait

- Strategy and Management

- Governance and Dialogue

- Product responsibility

- Employees

- Environment and Society

- GRI Disclosures

- Sites

Organisation and process of risk management

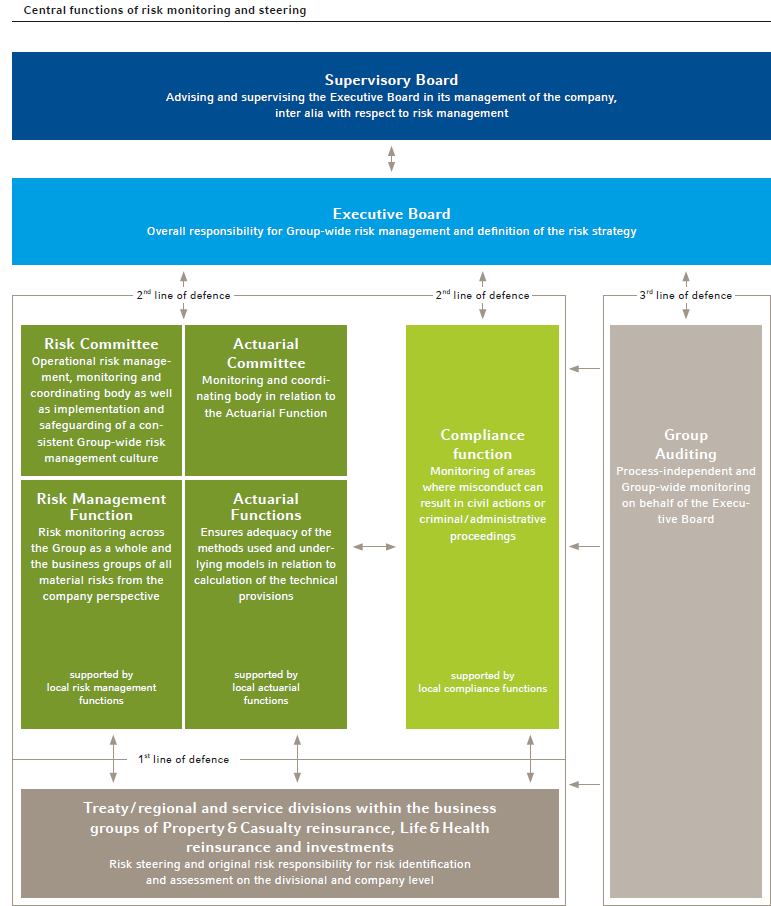

We have set up risk management functions and bodies Group-wide to safeguard an efficient risk management system. The organisation and interplay of the individual functions in risk management are crucial to our internal risk steering and control system. Responsibility for Group-wide risk management and the risk strategy rests with the Executive Board. The Supervisory Board advises the Executive Board on matters of risk management – among other things – in accordance with its Rules of Procedure.

The central functions of risk management are closely interlinked in our system and the roles, tasks and reporting channels are clearly defined and documented in terms of the so-called "three lines of defence". The first line of defence consists of risk steering and the original risk responsibility on the divisional or company level. Risk management ensures the second line of defence – risk monitoring. It is supported in this regard by the actuarial function and the compliance function. The third line of defence is the process-independent monitoring performed by the internal audit function. Supplementary to this, Group-wide risk communication and an open risk culture are important to our risk management. Regular global meetings attended by the actuarial units and risk management functions serve as a central anchor point for strategic considerations in relation to risk communication and risk culture. Furthermore, requirements for risk management are formulated in guidelines that are publicised throughout the company.

The following chart provides an overview of the central functions and bodies within the overall system as well as of their main tasks and powers:

Sustainability risks and opportunities

For the purpose of early detection of emerging risks we have had in place for many years an efficient process that spans divisions and lines of business and we have ensured its linkage to risk management. Operational implementation is handled by an expert working group assembled specially for this task. Along with the identification and evaluation of emerging risks, these specialists also focus on the analysis of global long-term trends. The working group reports quarterly on its findings to the Risk Committee, which is led by the CEO.

Key elements in our business opportunity management include the various market-specific innovations in the Life & Health and Property & Casualty reinsurance business groups. Innovative ideas from our staff that can be successfully translated into new business models are rewarded – including in financial terms. The "Innovation Management" department deals systematically with ideas and business opportunities and it concentrates its activities on generating additional premium volume with profit potential. In this context, among other things, ideas for new business opportunities are evaluated and refined and optimal framework conditions for acting on them are put in place.

Risk capital (Solvency II)

A stable financial market is of vital importance both for global sustainable development and for us as a listed company. In order, among other things, to offset the negative effects of fluctuations in the financial market, the European Union has adopted Solvency II capital regulations. Through our internal capital model approved by the BaFin, we comply with this risk-based regulation and allocate our capital as efficiently as possible. We are also able to leverage the know-how that we gained in the development of this capital model for the design of individual reinsurance solutions for primary insurers.